Energy Storage Project Internal Rate of Return

Energy Storage System Investment Decision Based on Internal Rate of Return

The sum of the discounted value of the cash flow of each year of the investment project is the net present value of the project, and the discount rate when the net present value

Quantifying the value of a solar installation: some helpful metrics

Internal rate of return (IRR) What is the internal rate of return? The internal rate of return (IRR) is similar to NPV in that it accounts for discounted future cash flows over the lifetime of the

Energy Storage System Investment Decision Based on Internal Rate of Return

Download Citation | On Jan 1, 2020, Jincheng Wu and others published Energy Storage System Investment Decision Based on Internal Rate of Return | Find, read and cite all the research

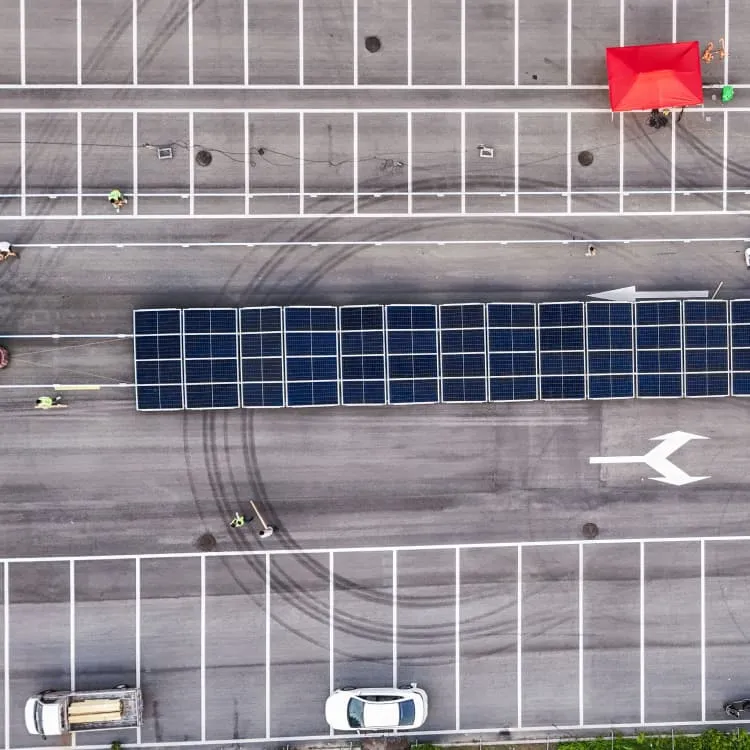

Energy Storage Sizing Optimization for Large-Scale PV Power Plant

The optimal configuration of energy storage capacity is an important issue for large scale solar systems. a strategy for optimal allocation of energy storage is proposed in this paper. First

6 FAQs about [Energy Storage Project Internal Rate of Return]

Is the internal rate of return a profitability measure for battery storage systems?

Multiple requests from the same IP address are counted as one view. This paper assesses the profitability of battery storage systems (BSS) by focusing on the internal rate of return (IRR) as a profitability measure which offers advantages over other frequently used measures, most notably the net present value (NPV).

Does internal rate of return matter in battery storage systems?

Author to whom correspondence should be addressed. This paper assesses the profitability of battery storage systems (BSS) by focusing on the internal rate of return (IRR) as a profitability measure which offers advantages over other frequently used measures, most notably the net present value (NPV).

What is internal rate of return (IRR)?

Internal Rate of Return (IRR) This paper is based on the IRR as a key economic metric for assessing the profitability of investment projects.

Should internal rate of return (IRR) be used to assess profitability?

We argue in favour of the internal rate of return (IRR) as a preferred method to assess profitability given the advantages over the popular net present value (NPV) and many other frequently used profitability measures.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Why is IRR important in battery storage?

Since battery storage purchase represents large capital expenditure for the observed BSS, the level of IRR greatly defines optimal battery size and overall operational setting.

More information

- The wavelength range of wind and solar complementary communication base stations includes

- Kosovo Huijue Energy Storage Equipment Parameters

- 60KW inverter weight

- Greek outdoor communication battery cabinet custom manufacturer

- Taipei Solar System Home Prices

- The world s first gravity energy storage project

- Cameroon simple photovoltaic combiner box

- Greek lithium energy storage power wholesale company

- Huijue French outdoor power supply

- Change to 220v inverter

- Gabon Mobile Photovoltaic Container

- The more flywheel energy storage the bigger the battery

- Belize Anti-corrosion Photovoltaic Panel Manufacturer

- 10 000W 48V inverter

- What is the price of commercial energy storage cabinets in Australia

- Small energy storage system

- Is there a 12kw inverter

- Mauritania Portable Energy Storage Power Solutions Company

- Kiribati Home Solar All-in-One 50w

- Disadvantages of 48v inverter

- Energy Storage Company Introduction and Product Introduction

- Gudian Energy Storage Project Cooperation Model

- Solar panels in the Philippines

- Solar energy projects are settled by watt

- Indoor solar photovoltaic panels

- Guatemala outdoor power supply wholesaler